News, Updates and

Things to know.

Update March 2025: Amended tax law for employee share awards approved by the Senate; awaiting the signature of the President of the Czech Republic. [...]

New / amended German tax rules aim at avoiding “dry tax” on employee shares in young / small companies. In a nutshell (latest status [...]

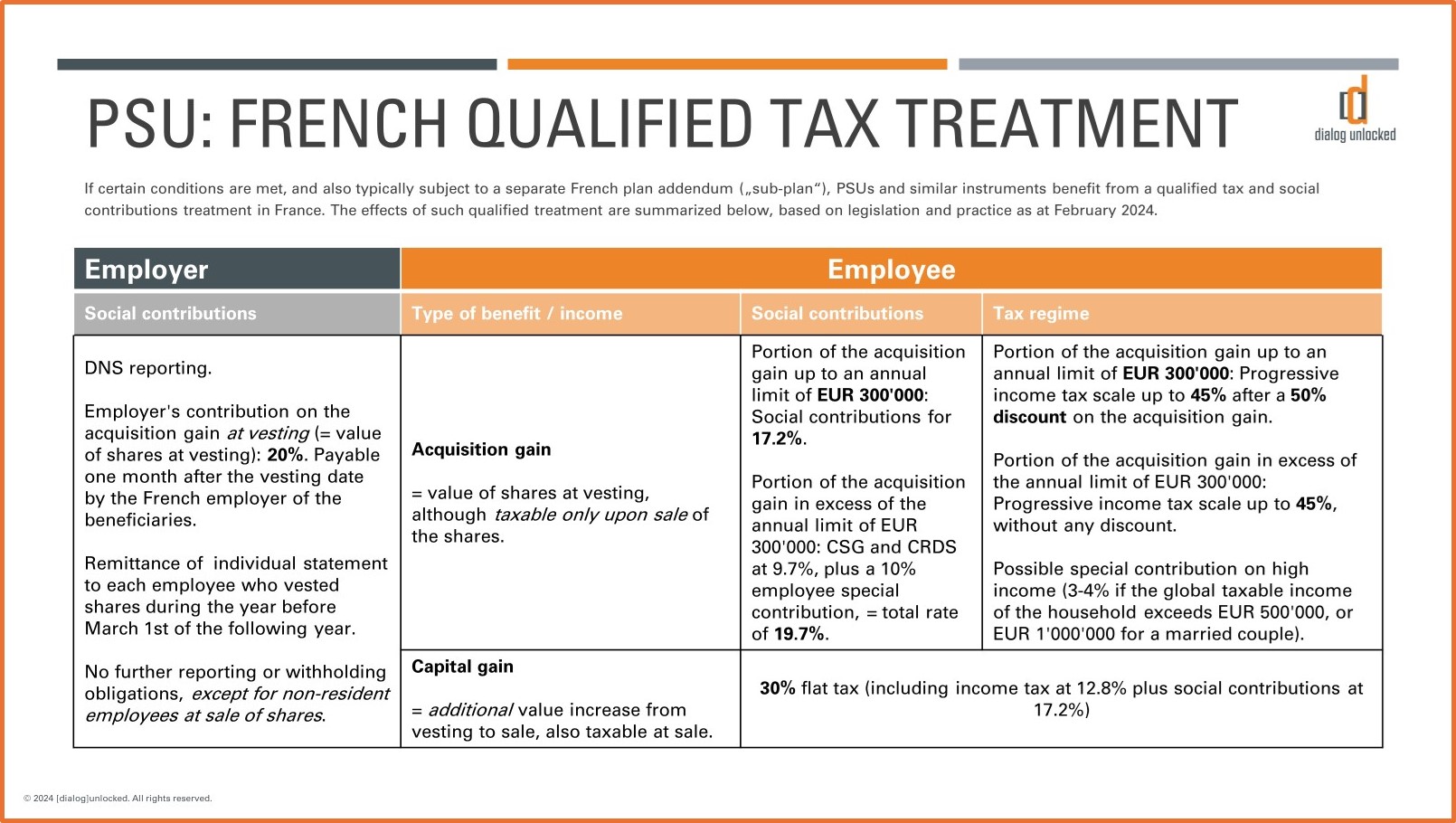

Update February 2024: Under certain conditions, employee share awards such as PSUs and RSUs, may qualify for a preferred income tax and social security [...]

Update September 2023: The offering of employee share plans in South Africa is subject to various requirements. On the foreign exchange control side, there [...]

Marc Seematter ([dialog]unlocked) and Stefan Wigger (Balmer-Etienne) talk about employee share plans in SMEs. A 5-minute video featured by Balmer-Etienne’s “Stefan will’s wissen” series. [...]

[dialog]unlocked's "Executive Compensation Report Switzerland 2023" is available now! Contents: Many graphs and details on board and executive compensation levels and pay mix in [...]

Update September 2023: The offering of employee share plans in South Africa is subject to various requirements. On the foreign exchange control side, there [...]

We have recently seen increasing client demand for “phantom options”, especially in SME (small and mid-sized entities) and start-ups. Please find below a few [...]

Update August 2023: According to current securities law rules and practice in Thailand, there is a reporting obligation towards the Thai securities and exchange [...]

Update July 2023: The offering of share-based long-term incentives (or employee share purchase plans, for that matter) may be subject to local legal and [...]