Employee Share Plans around the World: France

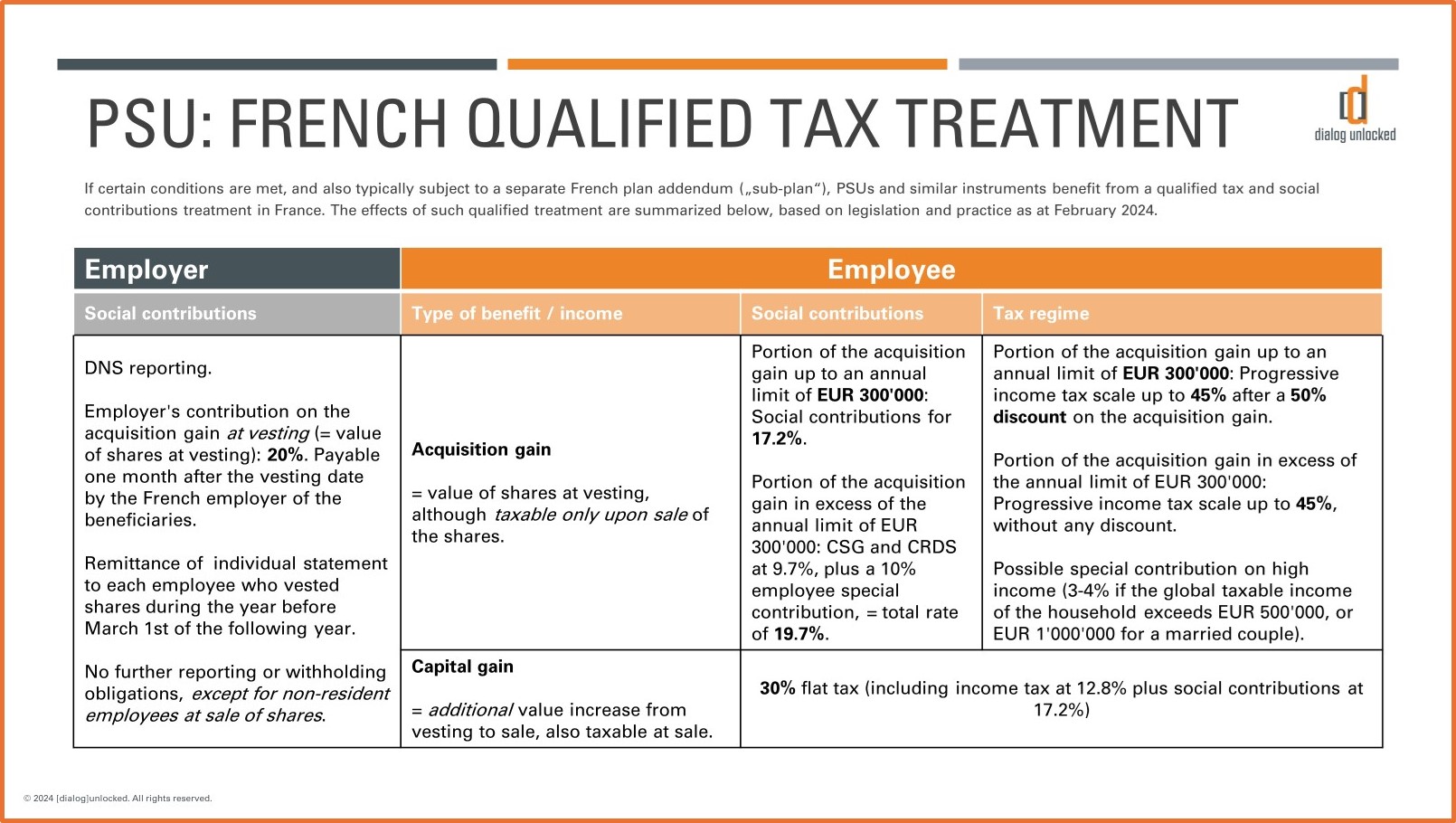

Update February 2024: Under certain conditions, employee share awards such as PSUs and RSUs, may qualify for a preferred income tax and social security treatment in France, coming with benefits for all parties involved. For the employees: Improved cashflow situation and lower tax burden. For the employer: Lower social security charges and no further payroll obligations upon sale of shares (except for non-resident individuals). The way to get there: Check if conditions are met; prepare and implement a French “sub-plan” (e.g., as an appendix to the main plan regulations). See overview attached.

For questions or support, please contact us.

(Thanks and credits to our French network partners, GALAHAD Legal)

Photo: Overview French qualified taxation, copyrights [dialog]unlocked.